The Best Kind of Tax to Pay: Capital Gains

Volume XIX, Issue 12

Most of our clients are buying their French properties, but a few of them have decided to sell. If these properties are not their primary residences, then there will be a tax to pay on the capital gain.

Before going any further, I’d like to remind you and all of those selling a secondary property that while tax isn’t fun to pay, and yes, it reduces your profits, capital gains tax is based on a PROFIT, so it’s the best kind of tax one can be assessed. If you haven’t “over capitalized” the property by spending too much on renovation or furnishings, than you should be able to walk away with a gain after several years of ownership (depending upon appreciation), while having had the pleasure of its usage, or having realized rental income along the way.

The gain is equal to the difference between the sales price (minus the transfer costs and the amount of Value Added Tax paid) and the purchase price (mainly the closing costs paid during the purchase or 7.5 percent of the purchase price), or the declared value when the property has been acquired by donation or inheritance (plus actual costs and transfer rights, free of charge, if these were borne by the donee or the heir).

The purchase price may be increased by the costs of construction, reconstruction, extension or improvement expenses, as long as these have been borne by the seller and carried out by a licensed company. The seller must present the supporting documents (invoices detailing all costs and VAT) to prove the expenses. The materials and works carried out by the owner himself are no longer deductible, so if you were thinking of DIY, you might want to reconsider that, as the tax authorities will not recognize these expenses.

In all cases, maintenance, and repair expenses, including major repairs, are not included among the expenses that can be taken into account, in order to calculate the capital gain. These concern works which are intended to maintain or restore a building, in proper condition and allow normal use. Furnishings and decor don’t count…only major home improvements that truly add value to the property, such as a second bathroom or a completely new electrical system brought up to code.

If you don’t have the documents, or don’t wish to go to all that trouble, the seller may increase the purchase value by 15 percent, if they have owned it for more than five years, on a flat-rate basis, without having to establish the proof of the works. The 15 percent flat rate is a simple option for taxpayers, who have owned their property for more than five years, even if it does not add up to the costs, which were borne by the owner.

Like most things in France, calculating the capital gain on the sale of property is not simple nor straightforward.

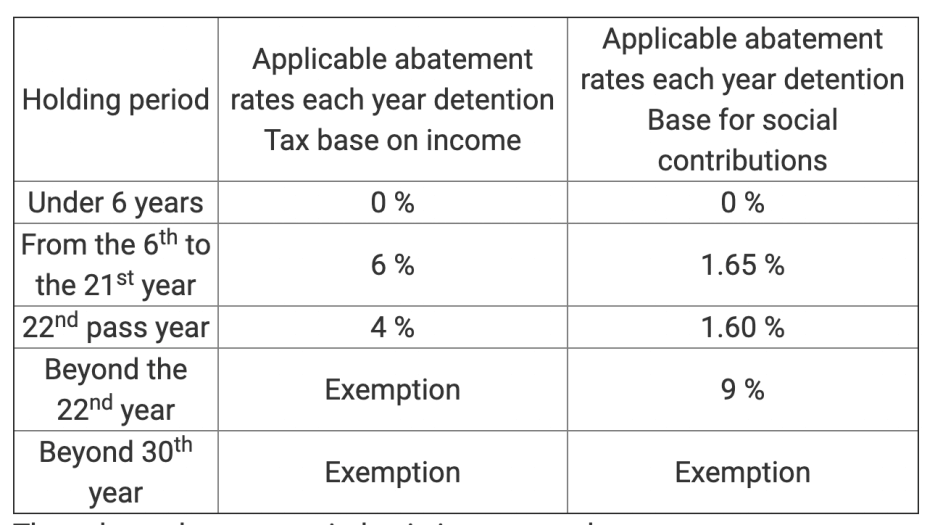

The capital gain is fully exempted as follows:

1) after 22 years of income tax detention

2) after 30 years of detention for social security contributions

The years of detention are counted from the anniversary of the property purchase (date of purchase, date of donation or date of death).

The capital gain is taxed under income tax at the current flat rate of 19 percent (with a linear reduction of six percent from the 6th year) and under social security contributions at the current rate of 17.2 percent (with a progressive reduction 6th year onward). An additional tax (from two to six percent depending on the amount of the capital gain after applying the reduction) applies to capital gains on property, other than on building land of an amount higher than 50,000€. The capital gains resulting from transfers carried out since January 1, 2013 are those now concerned.

Confusing? I told you it wasn’t simple! Fortunately, the Notaire and the tax assessor can provide you with a rough estimate—because it’s a useful tool to know in advance your tax liability prior to deciding to sell or not. The tax isn’t assessed long after the sale—it will be deducted from your proceeds at the time of signing the Acte de Vente (deed) and paid by the Notaire on your behalf to the tax authorities.

The capital gain regime varies depending on the sales price, the nature of the property, and the ownership duration. Given the concept of taxation, there are some cases of limited exemptions. There are two sure fire ways to eliminate capital gains tax: 1) declare the property as your primary residence or 2) own the property for 30 years or more.

One special note: for foreign owners who do not benefit from the social security contributions, this tax was declared unfair by the European Union, but France continues to assess it. You can try to claim a refund for this portion of the tax…but good luck! Have you ever tried to battle the tax authorities?!

The Chambre de Notaires de France offers up a capital gains tax calculation simulator in order to estimate the amount of your capital gain. Click here to try it out.

And if that’s not good enough, let us help you determine the tax and put your property up for sale with our North American market. For more information about listing your property with us, visit our services page.

A bientôt

Adrian Leeds

Adrian Leeds

The Adrian Leeds Group

(photo by Erica Simone)

P.S. Surprise, surprise, surprise..three of our recent House Hunters International episodes are still online at HGTV! Vist our HHI page for details and links to the episodes on HGTV for: “A Parisian Place for Mother and Daughter,””From Vancouver to the Vineyards of Epernay, France” and “The Good Life in Paris.”

2 Comments

Leave a Comment

To read more, click the links below.

I just wanted to say I noticed the long hair – looks great!

Thanks so much, but he photo is from a few years ago.