What’s Your French Property Costing You to Own?

Volume XIX, Issue 6

When you’re considering a purchase of property in France, one of the most important aspects of that ownership of which you should be aware are the “carrying costs.” These are the expenses you will incur to own and operate the property which include mortgage payments (if applicable), annual taxes, utilities, homeowner association dues (if in a multi-family building), insurance and then lastly, what you can anticipate for regular maintenance.

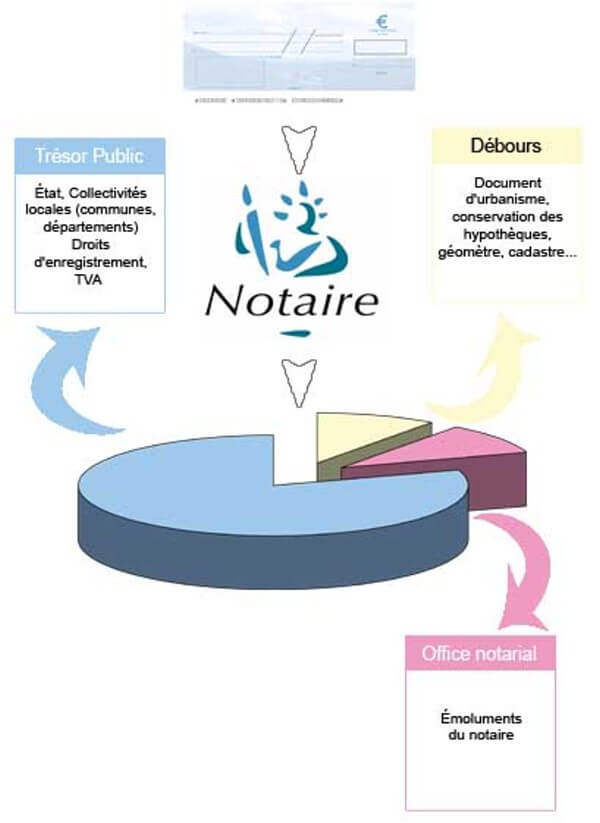

Before that, however, there are the closing costs—the Notarial taxes and fees that add to the investment, before you even begin to renovate or furnish it, incurred at the time of closing. Calculated according to the value of the property, their amounts vary depending on said property’s geographic location.

NOTARIAL TAXES AND FEES

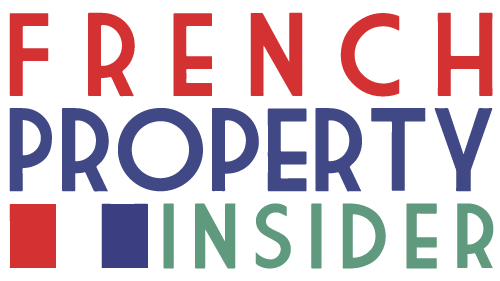

The Notarial taxes and fees are paid by the buyer upon the closing or final sale of the property. The French Notaires are responsible for collecting them on behalf of the state and remit them to the Public Treasury.

The taxes amount to about 8/10ths of the total fees. Disbursements amount to about 1/10th of fees—fees paid by the Notaire on behalf of its client and used to compensate the various parties and/or pay the cost of the various documents, but also to settle the exceptional costs incurred at the client’s request (e.g. certain traveling costs). The Notaire is compensated by about 1/10th and that amount is split if another Notaire represents the other party.

The bottom line is that between seven and eight percent of the net price of the property will be assessed for the Notarial taxes and fees. There is nothing you can do to negotiate these fees as they are highly regulated. This is a one-time cost and therefore you can consider it a cost of your investment.

For a very detailed look, visit Notaires de France and/or this link. To estimate the fees on a particular property, visit this page on their site.

MORTGAGE

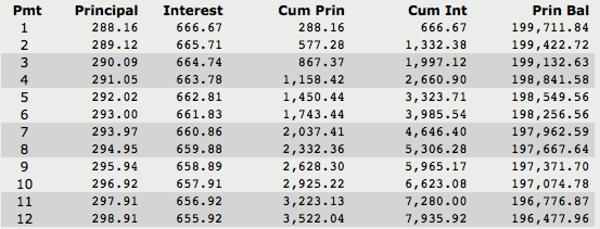

Now that you’ve paid the Notarial taxes and fees and own the property, the carrying costs are ongoing for the life of the property, or in the case of the mortgage, until the principal and interest are fully paid based on the terms of the loan. When calculating this expense, keep in mind that your carrying costs are not the principal payment, as that counts toward the price of the property, but the interest and other costs are, such as insurance associated with the mortgage. Also, keep in mind that there are tax advantages associated with the interest. Current U.S. tax law allows itemizing homeowners to deduct mortgage interest paid on up to $750,000 worth of principal on either their first or second residence. This limitation was introduced by the Tax Cuts and Jobs Act (TCJA) and will revert to $1 million after 2025.

TAXES: TAXE D’HABITATION + TAXE FONCIERE + REDEVANCE AUDIOVISUELLE

One of the most surprising aspects of property ownership in France is the low property taxes assessed annually on homeowners—considering that France is well-known to be a highly taxed society. On the whole, I find that property taxes are about 1/10th of what they are in the U.S.!

There are two taxes assessed annually: Taxe Foncière and Taxe d’Habitation.

The property tax, Taxe Foncière, is always paid by the owner of the property. The housing tax, Taxe d’Habitation, is in fact due by the one who has the use of the accommodation on January 1st: the owner, the tenant or a free occupant. Surprisingly, too, the figures for each have tended to be about the same, even though their basis is different…until now.

The basis for calculation of the Taxe d’Habitation is not nearly as simple as it is in the U.S., normally a percentage of the current assessed value of the property. In the case of France, the cadastral rental value of the property serves as a tax basis for the various local taxes. This rental value is set after consultation with the municipal or departmental direct tax commissions during land review operations and can be modified according to different events affecting the property. Yes, I know it’s a mouthful and why it’s pretty tough to determine the tax on your own.

To understand this in greater detail, visit this site (in French).

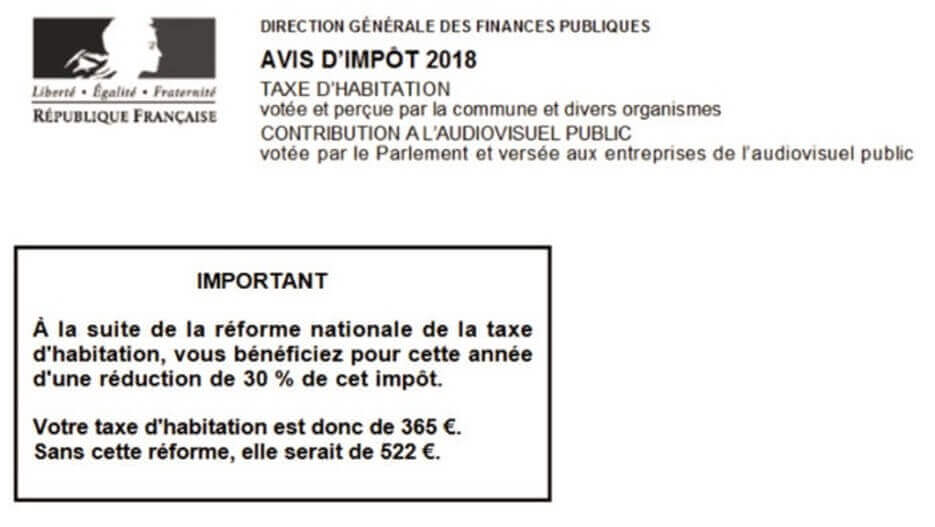

Taxe d’Habitation is an ongoing conversation among property owners and government administrators. While it is the responsibility of the occupant of the property on January 1st, it isn’t assessed or paid until the following Fall. The rules around Taxe d’Habitation have changed since Emmanuel Macron took office as President of the Republique, lowering them to the point of abolishing this tax to benefit those who can least afford them. The Macron reform will be gradually implemented until a total exemption in 2023.

For principal residences, there will be total abolition of the tax for all by 2023. Second homes are excluded from the exemption arrangements. Certain categories of taxpayers, such as the elderly, already benefit from an exemption from housing tax. In 2020, exoneration of the tax could have been 100 percent, depending on the income of the household. The housing tax is sometimes established in the name of several residents who may come from different tax regimes when, for example, adult children live with their parents. The administration then takes into account all the income of the residents concerned.

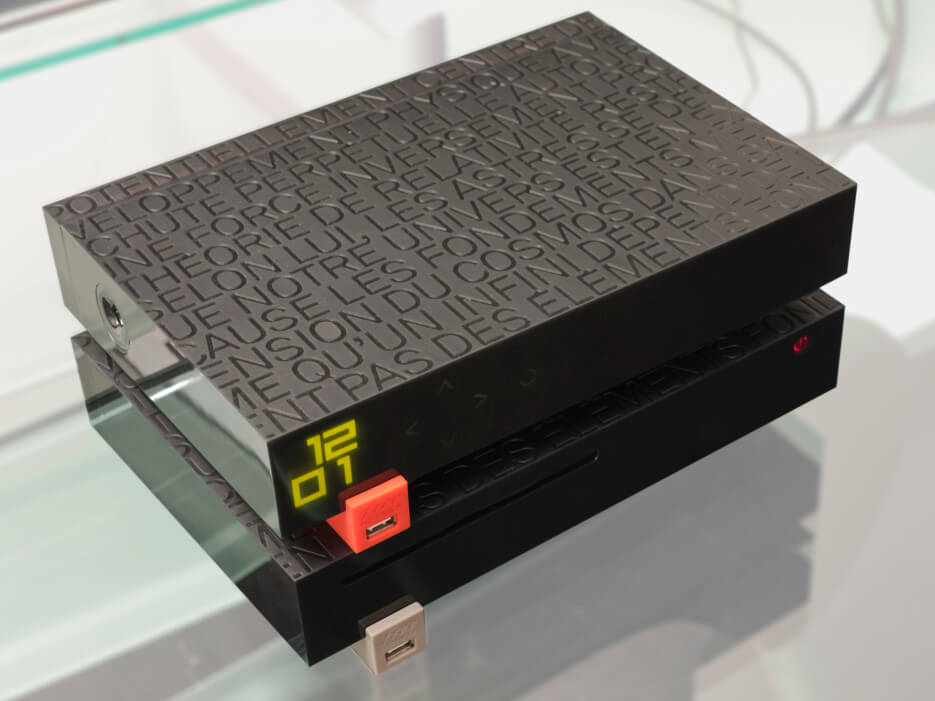

The redevance audiovisuelle for TV ownership in France is an antiquated tax that simply never went away. It’s assessed as part of the Taxe d’Habitation, and must be paid if the resident is liable for the housing tax and if they own a television or an equivalent device. It was at one time used to finance public television and radio broadcasters (France Télévisions, Arte-France, Radio France, RFO, RFI, and the National Audiovisual Institute). If the household does not own a television or an equivalent device, taxpayers must specify this on their income tax declaration to be exempt from the license fee.

UTILITIES: ELECTRICITY + GAS + WATER + INTERNET/PHONE/TV

You’ll find utility costs low in France, surprisingly. While the U.S. became a consumer society, Europe was watching its usage and therefore its pennies, focused always on saving energy in every way possible. You likely have already noticed this when the light in the hallways stays on for only a brief amount of time rather than burning continuously, or when using appliances that have economic/ecological settings.

Electricity

France boasts of one of the lowest electricity prices in Western Europe. According to Eurostat, at €0.1765 per kWh in 2019, the average cost of electricity in France is 26.5 percent cheaper than the E.U. average (€0.2159 per kWh), compared to Spain or Germany where prices are respectively 46% and 79% higher than France’s.

However, with electricity markets in France deregulated, customers have a choice of supplier and price plan, meaning the price you pay for electricity could be lower or higher than this figure. In 2020, seven out of 10 French people have an electricity contract with EDF and its Tarif Bleu (the regulated sale tariff for electricity). If most of them have a base meter option (with a price of electricity that is the same every hour of the day) and that the average power of the meter is 6 kVA, then we can assume the average price of kWh in France is €0.1582 and the annual subscription charge is €127.20. The average household in France consumes about 4770 kWh electricity (2019) and ranges from about €860 to €900 annually, depending on the electricity provider and plan chosen. This works out to an average monthly bill of about €71.67 to €75 per month.

Gas

If you’re lucky enough to have gas in your home or apartment, then you have the possibility of having continuous hot water (no water tank) and heat via a “chaudière” or boiler that heats the water as its run through it. It also affords you the luxury of a stove with gas burners, if you prefer that kind of cooking. About one-third of all households in France use natural gas for heating, hot water and/or cooking.

Natural gas is billed according to the amount of energy consumed, measured in kWh. The average price of natural gas in France is €0.070/kWh, which is slightly below the average for Europe (€0.073 / kWh). Of the households connected to gas, the average French household consumes approximately 11,800 kWh of natural gas per year, making the average natural gas bill in France approximately €830 euros per year, or about €69 per month. As residential gas markets are open to competition in France, you have a choice of energy supplier and natural gas plan, which means that the price you pay for your energy may be lower or higher than this average.

Water

Water in France is supplied by a number of private companies, the largest of which are the Saur group (part of Bouygues, which also supplies mobile phone services) Suez Environment (formerly Lyonnaise-des-Eaux) and Veolia Environment (part of Vivendi), that between them supply some three-quarters of the water in France. The water supply infrastructure, however, is owned and managed by local communes, so rates vary across the country. Most properties in France are metered, so that you pay only for the water you use and are charged per cubic metre (1,000 litres).

The Canal de Marseille, which supplies two-thirds of the drinking water of Marseille from the Durance River

You’re billed by your local water company annually or every six months and can pay by direct debit. If you own an apartment in a condominium, the water bill for the whole building is usually divided among the apartments according to their size as are the other maintenance charges. In some situations, there will be a separate meter per apartment so that you will be responsible only for your own usage and not more.

French water varies by up to 100 per cent in price from region to region, depending on its availability or scarcity, and is among the most expensive in the world, although rates include sewerage charges. If your property is on mains drainage (“tout à l’égout”), your water can cost as much as €3.60 per cubic metre or as little as €1.75; the national average is around €2.75. If it has a septic tank (“fosse septique”), on the other hand, your water bill will be much lower, e.g. €0.75 per cubic meter. The average annual water bill for a house in France is about €455, but rates are fixed by the local commune and range widely across the country.

Internet/TV/Phone

There are several companies in France that offer a “triple play” package that includes high-speed Internet, a Voice-Over IP phone and satellite TV with hundreds of channels. The main players dominating the market are Orange, SFR, Bouygues Telecom, and Free. Free is the second-largest ISP in France and claims to have invented the box concept when they released the “triple play” modems long before any of the others that had no choice, but to follow suit.

This is one of the biggest savings of all compared to life in the U.S. as their offerings start at €14.99 a month! And, you can add a cell phone for as little as €2 a month! You can get 5G service with unlimited calls and text messages to almost anywhere in the world at these rates. For the purpose of budgeting, allow €35 a month for a complete package + a cell phone at €20 a month.

HOMEOWNER ASSOCIATION DUES

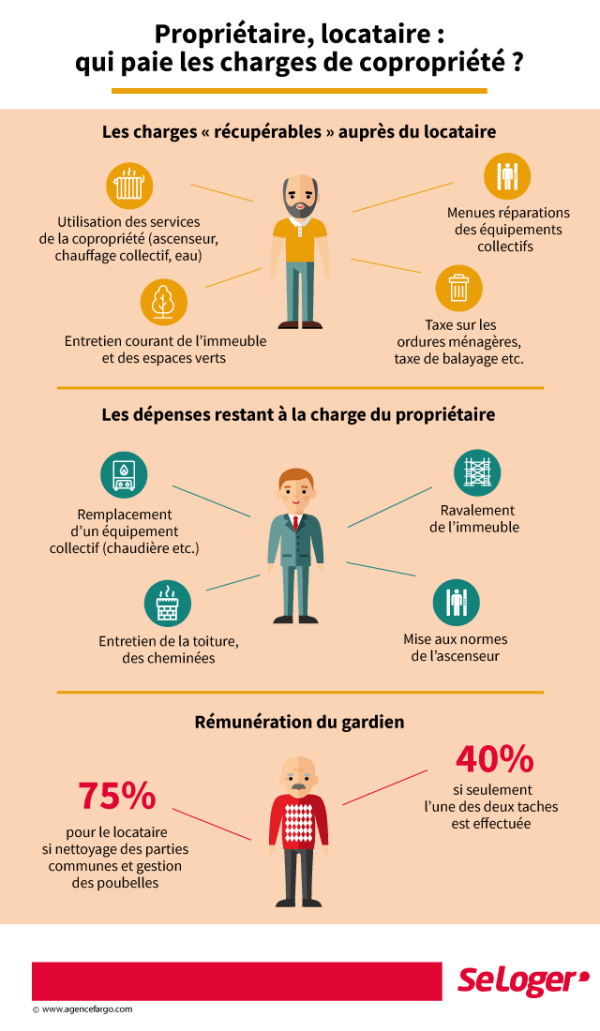

If your property is located in a multi-family building (condominium), you will pay what is known as “les charges”—or annual maintenance fees. The co-ownership charges correspond to all the costs generated for the operation and maintenance of a group of owners.

The calculation of the distribution of the payment of charges between the co-owners is defined in the co-ownership regulations, the share corresponding to the size of each lot of the co-ownership. The co-owners appoint a representative, the “syndic” (manager) of co-ownership, to manage the maintenance and the proper functioning of the building.

The general charges represent all the expenses incurred for maintenance (facelifting, structural work, painting, etc.), conservation (cleaning, security, lighting, etc.) and administration of the common areas (fees of the syndic, general meeting fees, etc.). The special charges include all the costs generated by collective equipment and services such as water, collective central heating, elevator charges, garbage chutes, etc. For example, someone who lives on the ground floor (and who does not have a garage or cellar in the basement) will not pay any maintenance and repair charges for the elevator. The payment of these costs will also be made in proportion to the residential floor. Those who live the highest will pay the most.

Scaffolding to resurface a building…the “ravalement”

According to the Union of Real Estate Syndicates, condominium charges in France average about €47 euros par square meter per year.

HOMEOWNER INSURANCE

In most situations, you will want to cover all risks with comprehensive insurance called MRH (MultiRisque Habitation) under French law. It covers all material damages (theft, fire, explosion, water damage, glass damage…) and it includes civil liability for all the people living in the home insured. There are the usual suspects in the insurance business in France such as AXA and Allianz, as well as the various brokers, but most of the banks also provide this service. They have either created their own subsidiary insurance companies or signed an agreement with an insurer to offer insurance to their clients: Pacifica/Credit Agricole, Banque Populaire/Maif, Société Générale/CGU and Credit Lyonais/Allianz.

According to figures released by the French insurance industry within the last two years, the average cost of an insurance policy for a house is €365 a year and for apartments, the average is considerably lower at €225.

MAINTENANCE

Everything listed above is what you can expect on a monthly or annual basis, but what about the extra maintenance that occur along the way, such as a plumbing mishap or a refreshment of the paint? Don’t forget to budget for these unexpected costs. There are a few ways of planning for these expenses. One is to simply take a percentage of the price of the property, such as a quarter of one percent, to set aside so that when you have to replace that old faucet, you’ll be ready.

Another and more realistic way is also much more complicated, but is something we use to create a “reserve fund” assessed for future maintenance. Create a spreadsheet detailing the current value of each item in the property, determine an estimated lifespan for that item, then estimate its replacement value multiplied by the inflation rate for each year of its life. Yes, I told you it was complicated, but it will give you a very realistic idea of how much money you should set aside for such situations.

You will also have building assessments to consider, such as the “ravalement” or resurfacing of the building which can be done as often as every 10 years. And if your building needs to repaint the stairwell, you’ll find yourself with additional costs—however, these assessments must be voted by the co-ownership so at least you should be a part of that decision and therefore forewarned and therefore forearmed.

THE BOTTOM LINE

The bottom line is that the carrying costs in France are considerably lower than you likely expect or that you are likely paying now in your home country, especially the taxes! And the good thing is that there will be no real surprises as you should be fully aware of the estimated future costs before ever signing the deed on your new French property.

A bientôt,

Adrian Leeds

Adrian Leeds

The Adrian Leeds Group

P.S. We had over 100 people on Zoom Tuesday with Harriet Welty Rochefort, discussing her newest book and first novel, Final Transgression at our monthly gathering, Après-Midi! You can read the report and watch the entire video by clicking here.

P.S. We had over 100 people on Zoom Tuesday with Harriet Welty Rochefort, discussing her newest book and first novel, Final Transgression at our monthly gathering, Après-Midi! You can read the report and watch the entire video by clicking here.

To read more, click the links below.